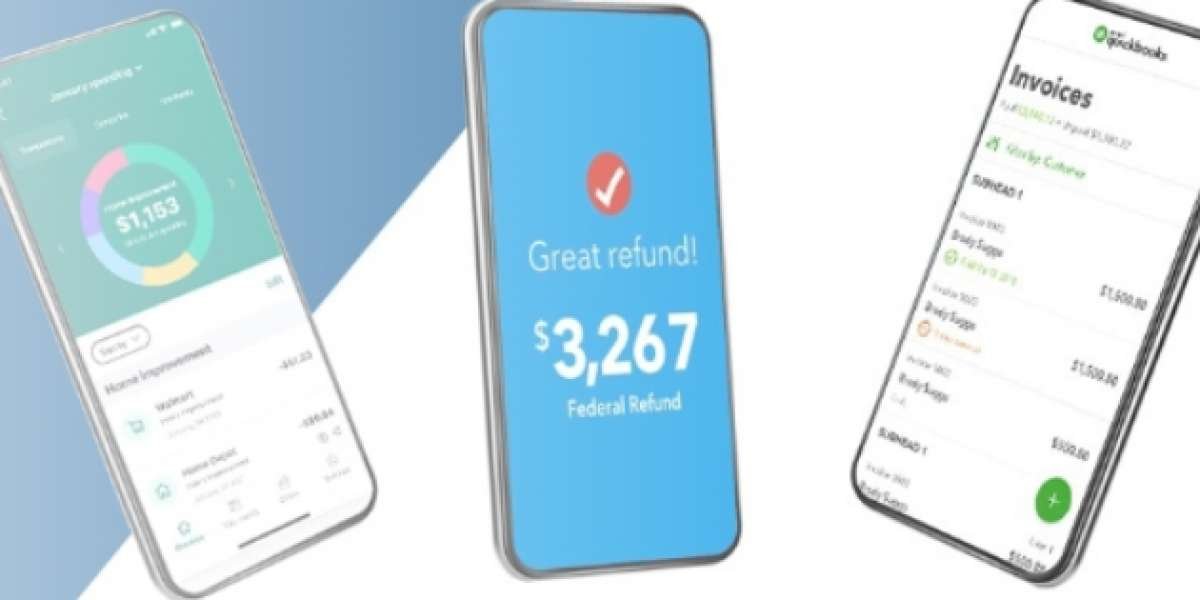

Install TurboTax.com: Download software for installation. Input tax info accurately, utilize guidance features for efficient return filing. Tax season can be a stressful time for many individuals and businesses alike. However, with the right tools and software, filing taxes can become a more streamlined and efficient process. If you want to resolve this problem regarding this, feel free to call us at- +1-844-508-2335.

Step 1: Download TurboTax- Visit the TurboTax website to download the software. You can choose between different versions depending on your needs, such as TurboTax Deluxe, Premier, or Self-Employed. Select the version that best suits your tax situation and click on the download button.

Step 2: Install TurboTax- Once the download is complete, locate the installation file on your computer and double-click to run it. Follow the on-screen instructions to begin the installation process. You may be prompted to review and accept the license agreement before proceeding.

Step 3: Choose Installation- Options During the installation process, you will be given the option to choose where you want to install TurboTax. You can choose the default installation location or choose a different directory on your computer. Once you've made your selection, click "Next" to continue.

Step 4: Install Additional Components- Depending on your tax situation and the version of TurboTax you've chosen, you may be prompted to install additional components or updates during the installation process. Follow the on-screen instructions to install any necessary updates or components to ensure the smooth functioning of the software.

Step 5: Create a TurboTax Account: After the installation is complete, launch TurboTax and follow the prompts to create a new account or sign in with an existing one. Creating an account will allow you to save your progress, access previous tax returns, and receive updates and notifications from TurboTax.

Step 6: Enter Personal Information: Once you've logged in to your TurboTax account, you'll need to enter your personal information, including your name, address, Social Security number, and other relevant details. This information is necessary for accurately filing your tax return and ensuring compliance with IRS regulations.

Step 7: Import Previous Tax Returns: If you've used TurboTax in the past or have tax returns from previous years saved on your computer, you may have the option to import this information into the current tax year. Importing previous tax returns can save you time and ensureconsistency across multiple years of filing.

Step 8: Begin Filing Your Tax Return: With TurboTax installed and your personal information entered, you're ready to start filing your tax return. Follow the prompts and instructions provided by the software to enter your income, deductions, credits, and any other relevant information. TurboTax will guide you through each step of the filing process and help you maximize your tax refund or minimize your tax liability.

Step 9: Review and File Your Tax Return: Once you've completed entering all your information, take the time to review your tax return for accuracy and completeness. TurboTax will automatically check for errors and inconsistencies and provide suggestions for corrections. Once you're satisfied with your tax return, you can proceed to file it electronically with the IRS or print and mail it if you prefer.

Conclusion: Installing TurboTax 2022 is a process that can streamline the tax filing process and ensure accuracy and compliance with IRS regulations.

Related Blog: How to Begin Installing TurboTax with License Code?